ASX Announcement

Wellard Ltd (Wellard, ASX:WLD) advises that it recorded its best full year Earnings Before Interest Tax Depreciation and Amortisation (EBITDA) result of $23.3 million in FY2020, as the Company began to realise the benefits of its debt restructure program to record its first full year financial profit since listing on the ASX.

It was a modest Net Profit After Tax (NPAT) of $0.2 million, but combined with almost doubling EBITDA, reducing net debt by around $103m or 92% year on year and still retaining $16.8 million cash at hand at financial year end, the Company is in a vastly superior financial position than it was 12 months ago, Wellard Executive Chairman John Klepec said.

“The changes we have made to Wellard’s debt structure, operating base and business strategy have begun to yield results,” he said.

“While we would have preferred a higher NPAT, it was a good result given the global COVID-19 disruptions during the second half. More importantly it demonstrates a positive trend over the last three years, and we are heading in the right direction. With low net debt, a healthy cash balance, reduced cost base and a reasonable order book of charter activity in the near term, the Company has started FY2021 in a robust financial position.

“We have completed our balance sheet restructure to provide the Company with greater financial resilience, and I’m pleased to say this is the first set of financial results since listing where Wellard is in full compliance with all of its financial covenants.”

Profit and Loss

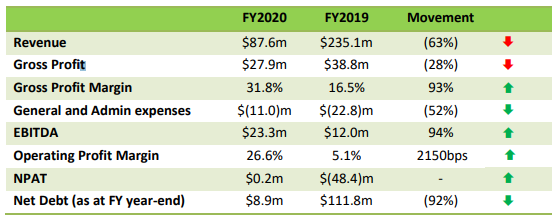

In line with Company’s move to scale back exporter/trader activity to focus on a livestock vessel charter business, revenue declined from $235.1m to $87.6m.

There was a corresponding reduction in gross profit, but, importantly, Wellard’s gross profit margin almost doubled from 16.5% to 31.8% with the transition in business activity.

Wellard’s key financial metrics continue to move in the right direction, Mr Klepec said.

EBITDA grew from $9.8m in FY2018 to $12m in FY2019 to $23.3m in FY2020. Similarly, NPAT has improved from a $36.4m loss in FY2018, a $48.4m loss in FY2019 to a $0.3m profit in FY2020.

The FY2020 result was aided by a further halving in operational and administration expenses as part of the cost savings that we continue to identify and implement.

“We are getting greater stability into our earnings and with the balance sheet restructure now completed, our interest bill has been reduced considerably. This is already enabling better conversion of revenue into profit for shareholders” Mr Klepec said.

“Our fleet is now right sized for the current market conditions, so although the fleet is smaller the company is more financially resilient with a more robust balance sheet and better fleet utilisation.

This places us in a good position to capture sustainable growth opportunities.”

“Importantly our cost reductions have not come at the expense of animal welfare outcomes and ongoing maintenance of the fleet, with management focussed on both these key success indicators.”

Balance sheet

Wellard continued with asset sales in H2 FY2020 as part of its balance sheet restructure, completing the sale of M/V Ocean Shearer for US$53.0 million.

Combined with the earlier the sale and leaseback of the M/V Ocean Swagman in H1 FY2020, Wellard used the proceeds to pay off both ship debt and corporate noteholders to reduce the Company’s net debt from $111.8 million on 30 June 2019 and $84.5 million on 31 December 2019 to just $8.9 million on 30 June 2020.

Nearly all the debt is now shipping finance and the ship loan to asset book value ratio has improved from 61.9% a year ago to 37.6% at the end of the reporting period.

Wellard is in full compliance of all financial covenants, the first time since listing on the ASX.

Coronavirus impact

COVID-19 has had some impact on the costs side of Wellard’s business, however demand for its vessels has remained largely, but not totally, unaffected.

The biggest impact on the Company’s operations has been the restricted ability to undertake crew changes and longer berth times at each port of call as countries adopted new procedures.

We have only recently been able to divert our vessels to ports where some crew changes could be achieved, increasing ballast voyage sailing times which has both a direct and an opportunity cost to the Company.

Only one voyage experienced a direct demand-related COVID-19 impact, when two charterers on a multi-charter voyage to Indonesia materially reduced the area chartered at late notice due to an importing customer issue related to COVID-19. No other charters have been directly impacted in this manner. Management of all regulatory changes and logistical demands resulting from the COVID-19 pandemic certainly add to the difficulty of negotiating, securing and delivering the

ongoing chartering of our fleet.

Outlook

The current outlook for H1 FY2021 is good with all available tonnage chartered (noting the M/V Ocean Ute has commenced six weeks of planned drydock in August) for the first quarter and a good pipeline of both confirmed charters and opportunities for the second quarter.

Chinese demand for Australian and New Zealand dairy and beef breeding cattle was a large contributor to Wellard’s vessels’ activity in FY2020 and shows no signs of slowing in FY2021. Wellard therefore expects to continue to charter our vessels to service that market.

In addition, the M/V Ocean Swagman is close to completing a successful charter from Chile to China with very good results, so transporting breeding stock from South America to China is a potential new market opportunity.

There is less certainty in FY2021 about Wellard’s two other core markets – Australian feeder cattle to Indonesia and Australian slaughter cattle to Vietnam. Throughout 2019 the prolonged drought in Australia kept supply high and cattle prices competitive with alternative proteins in importing markets.

The underlying demand for beef protein in these destination markets and others in the region remains high, including because African Swine Fever continues to negatively impact pork supply.

In 2020 Australian cattle prices started to rise, and at present are the highest in the world, presenting challenges for exporters servicing the Indonesia and Vietnam markets as they seek to compete with alternative proteins.

The Australian cattle trade to Indonesia and Vietnam remains important to Wellard. Despite expected high cattle prices remaining in FY2021 as the herd rebuild continues after drought, placing downward pressure on the volumes exported, there will still be a volume of cattle shipped albeit at lower volumes than previous years. Wellard has established a strong position in this market and is intent on defending and even growing that position.

The key South America to Turkey trade continues to remain uncertain, with import permits for small shiploads of cattle being released at present. If Turkey starts to release more import permits and for larger numbers, the M/V Ocean Drover could be deployed from its Australian base to that trade.

With this trade currently operating at a trickle, and Australia’s annual northern hemisphere summer live export suspension in force, most large vessels in the global livestock fleet have been at anchor awaiting the issuing of Turkey import permits. Until the idle shipping capacity is utilised in the market there is no likelihood of any improvement on ship charter rates in FY2021.

“There are both opportunities and challenges ahead for Wellard. We are however in the fortunate position that Wellard’s vessels are the ships of choice when exporters and importers need medium or large livestock carriers. Our balance sheet is robust, and our cash position is strong,” Mr Klepec said.

Animal welfare and government regulation

Under Wellard’s charter-focussed business model, the Company continues to ensure that every animal in our care is managed to the highest animal welfare standards. Given our larger than average, largely purpose-built vessels, our expert crew, and our rigorous emphasis on high standards of care, we continue to demonstrate that we can provide superior conditions for the transport of livestock to destination markets.

No reportable mortality voyages or Exporter Supply Chain Assurance System (ESCAS) breaches (from previously exported cattle) were recorded by Wellard during the current reporting period.

Wellard continues to support sensible and sustainable Australian regulations which move the industry away from mortality as the sole indicator of onboard animal welfare to alternative indicators.

Mortality does however remain an important animal welfare indicator and during the current financial year Wellard fleet reported one of the highest success delivery rates in its history:

- Of the 335,250 head of cattle loaded during the period, our vessels delivered 334,882 cattle, recording a success rate of 99.9%; and

- Of the 95,360 sheep loaded during the period, our vessels delivered 95,164 sheep, recording a success rate of 99.8%.

Regulatory and legal update

The Federal Court of Australia recently ruled in favour of class action plaintiffs in legal action against then Federal Agriculture Minister Joe Ludwig’s decision to ban the live export of cattle to Indonesia in 2011.

Wellard is a member of the class and was the largest cattle exporter to Indonesia at the time. At this stage it is unclear what the quantum of damages awarded to the class of plaintiffs might be or when any payments would occur.

Wellard has lodged its defence in response to a class action launched against the Company (see ASX announcement 10 March 2020).

The Company has been asked by a number of shareholders whether it possesses Directors and Officers (D&O) liability insurance. The specific arrangements Wellard has with its insurers are confidential, however, as would be expected of a listed public company, Wellard has various insurances in place to deal with a variety of risks and the Company would be expected to give ongoing consideration to its entitlements under any potentially relevant insurance.

Transition to US$ reporting

The Board of Wellard Ltd has agreed that Wellard will report its future financial results in $US, including its 1H FY2021 accounts.

The completion of Wellard’s strategic move from livestock trading to livestock logistics services and the consequent refocus on the chartering activity of its Singapore-based subsidiaries means nearly all of the Group’s revenue and expenses are conducted in US Dollars.

The Board has therefore decided to change the Group’s presentation currency of its financial information from the Australian Dollar to the United States Dollar with effect from 1 July 2020. This annual report will be the last report presented in Australian Dollars.

The Board believes that the change in the reporting currency will provide shareholders with a more accurate reflection of Wellard Limited’s underlying performance while reducing the impact of currency fluctuations.

At the release of the FY2021 interim and full year financial results, the FY2020 accounts will be restated in USD to provide shareholders with meaningful comparisons with the prior corresponding period.

Wellard’s FY2020 Annual Report including Results for Announcement to the Market; Directors’ Report, Remuneration Report and Audited Financial Statements are also released to ASX on 27 August 2020.

This ASX release was approved by the Wellard Board of Directors.

For further information:

Investors

Wellard Limited

Executive Chairman, John Klepec

Phone: + 61 8 9432 2800

Media

FTI Consulting

Cameron Morse

Phone: + 61 8 9485 8888

Mobile: +61 (0) 433 886 871